2025: Blockchain’s Breakthrough into the Mainstream

How blockchain entered the mainstream in 2025 and what it means for the future

Maciej Czajkowski

1/3/20267 min read

Key Takeaways

The blockchain technology cycle that we participate in, is far more impactful than previous ones

Regulatory turnaround of last few quarters is shifting the traditional mindset globally

The accelerating convergence of technology and finance is unlocking a new wave of systemic transformation

Introduction

Technology revolutions proceed through their development path in “S-curved” manner. Innovation with testing and niche adoption, Growth with rapid adoption, Maturity characterized with market saturation and finally Decline by either replacement by the newer one or becoming an unnoticeable standard like electricity. It is repeatable by definition, but the cycle we are currently in, is unique, let’s see why…

The year 2025 marked a decisive transition for blockchain technology - from a phase dominated by experimentation, fragmented regulation, and speculative narratives into one defined by institutionalisation, regulatory clarity, and pragmatic adoption.

After more than a decade of development, blockchain has entered a growth phase in which governments, financial institutions, and global enterprises are no longer asking if the technology will be adopted, but how and under what conditions. Three forces shaped this shift most strongly in 2025:

Regulation, providing long-awaited legal certainty

Technological consolidation, improving scalability, interoperability, and usability

Adoption at scale, particularly in finance, payments, and real-world asset tokenisation

This is an attempt to summarise the most significant blockchain-related developments of 2025[1] and outlines what they imply for decision-makers, investors, and organisations planning their next steps in the digital economy.

1. Regulation: From Constraint to Strategic Foundation

The GENIUS Act and the Turning Point in U.S. Policy

One of the most consequential events of 2025 was the passage of the GENIUS Act in the United States. It was a fundamental pivot toward a more business-friendly environment. For the first time, the U.S. introduced a comprehensive, forward-looking regulatory framework for stablecoins and digital asset infrastructure, addressing long-standing concerns around:

Reserve requirements and transparency

Consumer protection

Systemic financial risk

Institutional accountability

Crucially, the GENIUS Act marked a shift away from regulation-by-enforcement (used by the previous SEC administration) toward rule-based oversight, providing market participants with clarity rather than ambiguity. July 31st Paul S. Atkins, SEC’s Chairman has delivered a speech conveying “American Leadership in the Digital Finance Revolution”. He mentions there “”Project Crypto,” which will be the SEC’s north star (…)”. This is a Copernican revolution.

Strategic implication:

Legal certainty significantly lowers institutional risk. As a result, stablecoins and tokenised instruments are increasingly viable for use in payments, treasury management, and cross-border settlement. Moreover, according to an ambitious vision, USA set an unprecedented pace for other countries and not only it becomes a “crypto capital of the world”[2][3] but also provides additional demand for the dollar. Which actually looks like a “digital remake” of the "petrodolar deal" from 1970s.

Regulatory Momentum Beyond the U.S.

While U.S. policy captured global attention, other regions worldwide made notable progress and prove that serious adoption is the matter of time.

Hong Kong Launched a roadmap to improve crypto hub competitiveness, including potential revision of strict custody rules; rolled out stablecoin regime with a high bar for licensing[4]. The word “competitiveness” seems to be the key here as a response to President Trump’s administration moves.

Japan moved toward regulating crypto as securities rather than payment services, advanced stablecoin licensing, and prepared for major tax cuts to boost domestic crypto markets

Emerging markets, including Pakistan, established dedicated crypto government agencies and partnerships to drive market growth and to coordinate blockchain strategy, regulation, and industry engagement.

United Arab Emirates Consolidated regulatory frameworks into a coordinated national strategy; expanded stablecoin rules and finalized federal framework for security and commodity tokens

Europe, building on MiCA foundations, focused on implementation and cross-border consistency to provide legal certainty. On the other side criticized by smaller crypto/Web3 innovators and DeFi sector for raising too big barriers like high compliance costs, capital requirements or discouraging EU-based DeFi entrepreneurship.

Together, these exemplary developments signal a global convergence toward regulated blockchain ecosystems, even if execution remains uneven across jurisdictions.

Regulation as an Enabler, Not an Obstacle

The narrative around regulation has fundamentally changed. Before tectonic shift in U.S. from Biden’s repressive administration to Trump’s supporting one, there were few “pro-crypto” islands in the world. To name a few: El Salvador, Switzerland, UAE, Singapore. After the “shift” in 2024-2025, regulation increasingly started to function as:

An enabler of institutional participation (especially for stablecoins)

A filter separating sound projects from those vulnerable for regulators’ scrutiny

A precondition for enterprise-grade adoption

This dominant narration seems to be dominating regardless of the context or location experienced by the author – from ETH Warsaw conference, through panel discussions e.g. during Bitget Crypto Elite in December, to widely expressed government officials' views on blockchain development during Blockchain Life’25 in Dubai.

It opens a window of opportunity for consulting and advisory firms. Respond to a demand for regulatory translation helping organisations map legal requirements into viable operating and technology models.

2. Technology: From Innovation to Infrastructure, but Security still an issue

Scaling and Modular Blockchain Architectures

Rather than introducing radically new base layers, 2025 was characterised by the refinement of existing architectures.

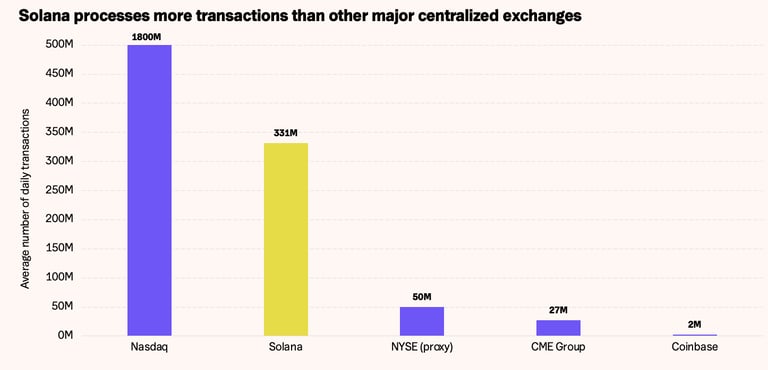

For example Solana is already processing more transactions than some major centralized TradFi exchanges.

Source: 21sharesLayer-2 solutions continued to reduce the throughput limitations of Layer-1 blockchains and to enable lower transaction costs and faster interactions with Arbitrum as a top example.

Modular blockchain stacks allowed separation of execution, settlement, and data availability.

Parallel to those developments, security is still a challenge. Blockchain security incidents led to losses of almost $2.94 billion (+46% YoY) across 200 separate events in 2025, according to a new report by cybersecurity firm SlowMist. With the most spectacular of $ 1,5 bln stolen from ByBit exchange in first quarter of 2025.

Despite the threats, these developments reflect a broader trend: blockchain is increasingly treated as infrastructure, not experimentation.

Tokenisation of Real-World Assets (RWA)

One of the most tangible technological and financial shifts of 2025 was the acceleration of real-world asset tokenisation.

Tokenised representations of:

Equities

Bonds

Funds

Commodities

and others

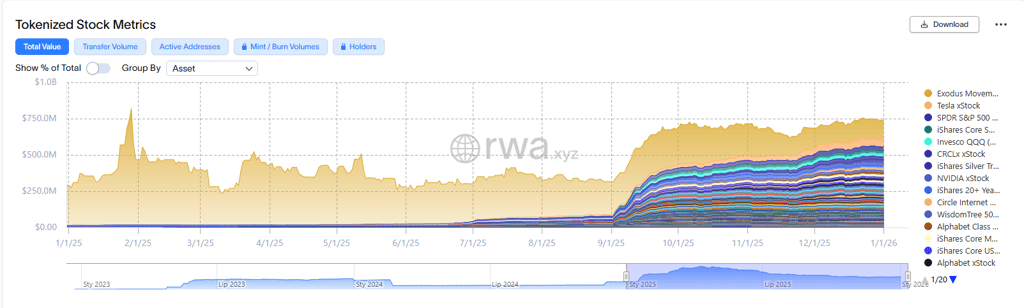

began moving from pilots into controlled production environments. The appeal is straightforward: faster settlement (near-instant), programmable compliance, and global accessibility. There is a visible spike since September attributed to Ondo Finance’s launch of its global platform - Ondo Global Markets - unlocking direct access to 100+ tokenized U.S. stocks and ETFs and to JAAA - tokenized structured credit fund launched by Centrifuge.

Source: rwa.xyz

Tokenisation is no longer theoretical - it is becoming a structural feature of modern capital markets reaching the total value of all tokenized stocks at $ 738 M. Although it doesn’t sound substantially big, the value transferred through those tokenized stocks in last 30 days amounts to $ 2,4 B (end of 2025).

AI and Blockchain Convergence

Another defining theme was the practical convergence of artificial intelligence and blockchain:

AI-driven agents for DeFi interaction and risk analysis

On-chain compliance and fraud detection enhanced by machine learning

Intelligent orchestration of smart contracts and workflows

This combination introduces a new paradigm: autonomous, auditable digital systems operating with minimal human intervention. Those two trends augment each other – AI supports and streamlines building blockchain-based solutions and those in turn, build the rails for native AI agents applications.

3. Adoption: Blockchain Enters Core Business Processes

Financial Institutions Lead the Way

Banks, payment providers, and financial infrastructure firms were among the most active adopters in 2025. Use cases included:

Stablecoin-based payment rails (stablecoins now settle more value annually than Visa)

RWA tokenisation (e.g. first tokenised structured note for private investors issued by UniCredit or fully tokenised minibond of €5 million for E4 Computer Engineering co-subscribed by UniCredit)

Despite disrupting traditional finance, blockchain is at the same time being embedded within it.

Enterprise and Government Use Cases

Beyond finance, blockchain adoption expanded across:

Supply chains (traceability, compliance, provenance) - blockchain adoption improved food safety and product authenticity - e.g. Walmart’s system enables end-to-end traceability of pork supply chains in China, while luxury brands such as Louis Vuitton and Prada use blockchain to verify product authenticity and combat counterfeiting.

Land & Property Registers - e.g. the city of Amravati in India partnered with Polygon in late 2025 to move municipal records, including land titles and tax data, onto a blockchain

Energy markets - among others Germany is developing the government-funded Blockchain Energy Initiative to advance blockchain use in renewable energy verification. Apart from that peer-to-peer trading of energy surplus on smart contract built architecture is used in several countries.

These implementations share a common trait: blockchain is used more and more widely, where immutability, transparency, and decentralised trust provide measurable value. And in fact there are no application limits industry-wise.

4. What 2025 Tells Us About the Future

Based on developments in 2025, at least three forward-looking conclusions stand out:

Regulation will continue to legitimise and standardise blockchain markets

Tokenisation will reshape capital markets and asset ownership

AI-enabled blockchain systems will define the next generation of digital infrastructure

Blockchain is no longer a peripheral innovation. It is becoming a strategic layer of the global digital economy.

Conclusion

The significance of 2025 lies not in hype, but in consolidation. Blockchain matured into a regulated, scalable, and increasingly trusted technology stack.

And now in order to clos the "teaser clause" from the introduction stating that this time is different. Currently we are not only observing a particular technology revolution like electricity, computers or internet. This is exponentially greater because what is happening on our eyes is a multi-generational convergence of trends forming a Copernican-scale breakthrough. This is a mix of:

new technological paradigm, merging with already lasting AI revolution

completely different, adjusted to digital world system of creating, storing and exchanging value

plus a socio-philosophical phenomenon organising freedom-thinking people around sovereignty idea.

Due to the character and complexity of this process it is very difficult to forsee the exact outcome, but it is clear that active participation is essential to adapt and position effectively for the future - while remaining outside this transformation increasingly poses the risk of strategic irrelevance.

For organisations, the key question is no longer whether to engage with blockchain - but how to do so strategically, compliantly, and with long-term value creation in mind.

This is precisely where informed advisory, architectural design, and strategic guidance become critical.

For strategic blockchain advisory, contact at: contact@bithorizon.eu

----------------

Footnotes:

[1] This period actually starts in 2024 with first BTC spot ETF launch and evolves and strenghtens in 2025

[2] https://www.sec.gov/newsroom/speeches-statements/atkins-digital-finance-revolution-073125

[3] https://www.whitehouse.gov/issues/tech-innovation/

[4] https://www.trmlabs.com/reports-and-whitepapers/global-crypto-policy-review-outlook-2025-26

Disclaimer: The content published on BitHorizon is intended solely for informational and educational purposes. It does not constitute financial, legal, or investment advice, nor does it reflect the views or recommendations of BitHorizon regarding the buying, selling, or holding of any assets. All investments carry risk, and you should conduct your own research or consult with a qualified advisor before making any financial decisions. You use the information on this website entirely at your own risk.